A trade-off experiment has two sides: offers and responses evoked by the offers. Analysis of the responses (choices or evaluations, or both) given the offers, provides specific values called part-worth to the features buyers are considering when making purchase decisions. With this knowledge, marketers can focus on the most important features to address the targets.

People's real-life decisions are influenced by implicit aspects that cannot be foreseen by researcher. As no question can be asked about the unknown, such information is not available from the standard verbal interviewing. It is believed at least some implicit aspects are projected in evoked choices. The utilities obtained from a conjoint study are therefore often called "as if" utilities as they comprise effects related to unknown endogenous aspects such as experience, perceptions, attitudes, needs and expectations. As these effects vary among individuals, individual behavioral data are required.

A typical set of stimuli to be presented to a respondent is made of product concepts called profiles. Each profile is made of a set of features called attributes. Every attribute is set to one of its two or more mutually exclusive levels. The concepts must be comprehensible and distinguishable from one another. Their complexity and number should not exceed a threshold above which respondents tend to resort to simplified statements and decisions.

The preferences obtained in a research study are called "stated preferences" (SP) to distinguish them from the "revealed" preferences (RP) reflecting actual behavior, i.e. the market data. Conjoint analysis mostly relies on conversion of stated preferences to attribute level part-worths under the assumption of their additivity known as conjoint additive kernel. In plain words, the level part-worths, when summed up in an appropriate way, make up utilities of the concepts. Utilities can be interpreted independently as stand-alone values, but their use is namely in what-if simulations thus allowing an interpretation in context of the competing products.

As aside to preference

As aside to preference

At this point it is important to remember that the "utility of the product" is not property of the product. It is a value quantifying respondent's view of the product as seen when "considered jointly" in the conjoint exercise.

As aside to design

As aside to design

Success of a conjoint study starts with its design. The formal rules, ensuring estimability of part-worths as known from the applied statistics of DOE - Design Of Experiments, are common to all types of conjoint methods. Reliability of estimates related to the ultimate goals of the study has the highest priority. It is wise to rely on a commercial design software and comprehensive tests of the generated designs.

The actual sequence of steps should have approximately the following order.

An often encountered problem is a request for a too broad scope of a

study. Limitations such as duration of the interview, the stimuli

presentation formats and their comprehensibility, the ability, fatigue and

willingness of respondents to cooperate, and other objective and

subjective factors should be respected. There is always a complexity limit

above which the parameters (part-worths) become biased or inestimable. It

is responsibility of the study designer to find, suggest and guarantee an

optimal solution.

When a broad range of the products is to be tested the CBS - Choice Based Sampling allows for making the range of offered products narrower and closer to the respondent's consideration set.

There is a broad range of techniques for eliciting values people place on

the attributes (features) that define products and services. The list of

the most often used basic methods for estimation of preferences between profiles

shown below is far from being exhaustive.

Conjoint interviewing methods have many variants of many flavors. In

general, the most reliable are methods based on choices from

randomized sets. A sufficient number of choices is needed.

Ranking belongs to the earliest methods. Compared to a single-choice method, a lower total number of profiles is required to obtain the same amount of information. On the other hand, ranking suffers from the inherent correlation of choices which may cause bias of utility estimates.

Pure rating always brings in uncertainty due to frequent ties and the fact that actual meaning of the stated values is unknown. Estimation bias is hardly avoidable.

As aside to ACA

As aside to ACA

A possible approach for products bought concurrently and in differing quantities is the Volumetric Conjoint method, a variant of the chip allocation method. Results from a volumetric exercise can be calibrated to the known market data which is typical for a category of FMCG/CPG (fast moving consumer goods, consumer packaged goods). Just like the classic approach using Fourt & Woodlock and Parfitt & Collins models, the method suffers from inability to separate the trial from the repeat probabilities.

The problem of products purchased concurrently in supposedly fixed

quantities, usually by a single piece, can be solved using MBC - Menu based Conjoint. A

satisfactory solution of a similar problem of products purchased

concurrently in varying quantities is yet to be found. A simplification by

splitting it into several smaller problems is usually inevitable.

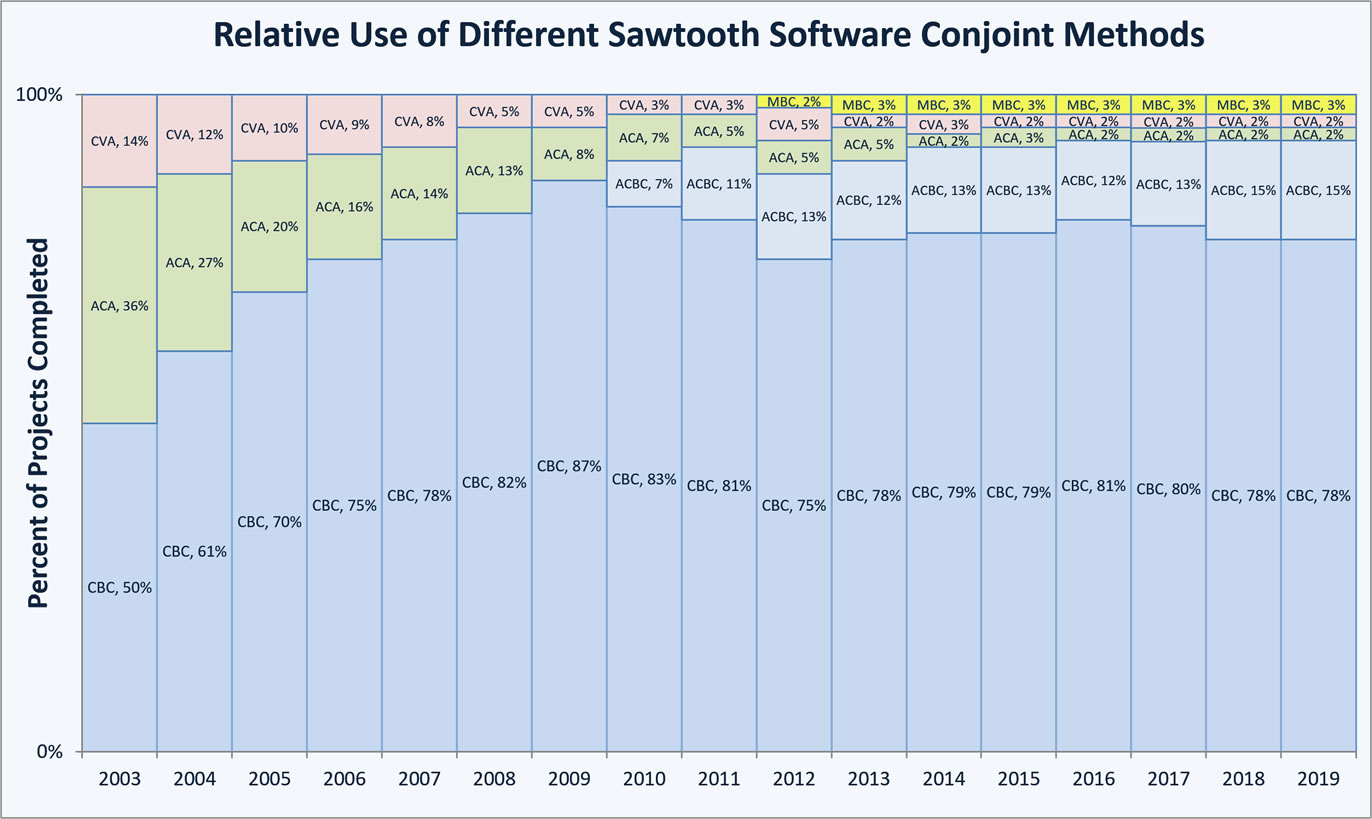

Below are the findings from tracking the use of conjoint-related methods

among users of Sawtooth

Software, Inc. (cit.).

As aside

As aside

| Attributes (features) of conjoint profiles should ideally be |

|

| Levels of attributes can be values of any standard type of MR variables. They should be |

|

The above conditions cannot be always satisfied, often due to the natural restrictions in combinations of attribute levels and/or limitations in concurrent presence of some profiles in a choice set. The discrepancies can be resolved by partitioning a broad attribute range into sub-ranges corresponding to mutually exclusive or partially overlapping product classes, or by modifying attributes and their levels as described on page Attribute Properties and Models so that the desired properties are met.

Attribute level descriptions should be as concise as possible, resembling

catch words or key phrases. Their explanations should be given before

the exercise is started and, possibly, available as help during the tasks.

Some authors claim several tens of attributes are feasible to be

interviewed and evaluated provided a "special" interviewing method is

combined with a "special" method of estimation. In our view this is

possible but the outcome is disputable. Probably the most popular is ACA -

Adaptive Conjoint Analysis due to its inherent use of partial profiles.

Usually only 5 randomly selected attributes are shown at a time.

Comparison of a number of results from ACA studies showed that, in too

many cases, only two or three attributes were identified as important

while the importance of all the others were nearly

indistinguishable.

Our experience with CBC - Choice Based Conjoint suggests that a product can be described with up to 6 or 7 attributes without a substantial loss of respondent's attention provided the profiles are easily understood. Increasing the number to 8 or 9 attributes and using partial profiles could not be termed as unsuccessful, but the part-worths of the alternately omitted attributes had to be scaled down. An attribute shown less often will gain on importance because when shown it will arouse more attention than an attribute shown more often.

As aside

As aside

So that levels of all attributes are shown equally often requires attributes to have the same number of levels. Attributes with more levels have tendency to obtain higher importance simply due to the more frequent change of the shown value.

When an attribute has many more levels than other attributes it has proved effective to use only a subset of "representative" levels in the conjoint exercise. The preferences among the full set of levels can be estimated in a separate MXD - Maximum Difference Scaling or SCE - Sequential Choice Exercise, and then merged with the data from the conjoint exercise. Ordinal or quantitative levels can be often separated into groups that are assigned to product classes. This is especially useful in case of a broad range of prices.

Profiles for a conjoint study may be either designed in advance or be generated (and possibly modified) during the interview. Each respondent can be shown either the same set of profiles, or one version of several versions of profiles, or each respondent is shown a different, randomized set of profiles generated by a design program.

Brand is a vehicle carrying implicit properties and image of a product. There is a profound difference between branded and non-branded presentation of stimuli to respondents.

The question common to all tasks in a conjoint block should be aimed at the action or event probability that is to be estimated and modeled. Improper wording may cause a misinterpretation of the task. The most common mistake is to ask a general question about "most attractive", "most advantageous", "best", etc., profile. The question should be formulated in the frame of PEBSE model (personality, expectations, behavior, situation and environment), and evoke the conditions close to those the outcome will be modeled for.

The feel and look of a task presentation plays an important role as well.

Graphics, if used, should be of the same graphical design and quality for

all equivalent items. Regularity and evenness is more important than the

actual quality. Clients can usually provide good visual representations

(pictures, videos) of their own products but often forget about the

competing products included in the test. Such a situation is very

difficult and should be remedied at the very start of the project design.

Some analysts use several "holdout" tasks, identical for all respondents and interspersed among randomized tasks. The purpose is to validate the current or select an alternative model of choice behavior by comparing the choice probabilities from the holdout tasks with those calculated from the current model, usually with the holdout tasks excluded from the estimation. The simplest approach, often used in CBC as a check of internal consistency, is to compute the percentage of correctly predicted choices. It relies on mutual independence of the choices in holdout and estimation tasks thus resembling the bootstrap methods for checking data validity.

Profiles in holdout tasks are usually designed in a managerial way and their attributes are correlated. This is why the answers to holdout tasks should not be included in the model as the risk of parameter estimation bias is quite high.

| Holdout tasks may be useful in the following cases: |

|

| We use holdout tasks only seldom for the following reasons. |

|

The estimated utility of a product is a function of part-worths of the individual attributes and their interactions, in case of the additive model as their sum. It is of advantage to work with individual-based part-worths. This, in most practical cases, allows to neglect between-attribute interactions that are the most frequent reason for heterogeneity of the sample estimates. The following estimation methods deserve mentioning.

As aside

As aside

Utilities estimated from conjoint exercise reflect the preferences that respondents revealed through their answers to the stimuli in a study. While metric methods based on ratings or stated purchase likelihoods lead to stated utility values, utilities obtained from a DCM-based method are only relative measures of preferences. These "raw" utilities can be interpreted only as differences, e.g. in preference share simulations with shares summing to 100%.

In order to estimate measures specific for any simulated product concept such as stated acceptance, projected sales, competitive potential or other "absolute" measures, calibration questions outside the framework of the conjoint method must be asked and applied. Calibration values are usually purchase likelihood statements on a set of product profiles. The calibration is a regression-based modification of raw utilities to reflect the calibration answers.

A calibration procedure provides expected stated values. To estimate market derived values, market data would have to be known.

Dimensionless nature of DCM allows for combining data from several sources and estimation of the common parameters. Some data may come from standard MR questions converted to a DCM format. This gives a way to various hybrid methods.

Additional data may come from questions designed to obtain preferences within separate groups of aspects such as levels of a single attribute. The data can be used as "soft constraints" for the data from a CBC exercise thus allowing for improving the estimates. When an exercise known as the Best-Worst Case 2 [Louviere et al., 1995] is added levels of all attributes can be put on the same scale. This approach is known as CSDCA - Common Scale Discrete Choice Analysis.

The questions on preferences of attribute levels may classify the levels

as acceptable and unacceptable thus providing prior estimates of

acceptability thresholds for the attributes. The thresholds can be used in

a non-compensatory model for perceived acceptability of simulated products

(the link is under preparation).

In the ideal case the computed part-worths contain the comprehensive information obtained from the DCM model. No wonder many conjoint analyses end with computation and presentation of part-worths or their simple transformations. There are still several more methods of utility interpretation and presentation.

As aside

As aside